2026 Charleston Market Forecast

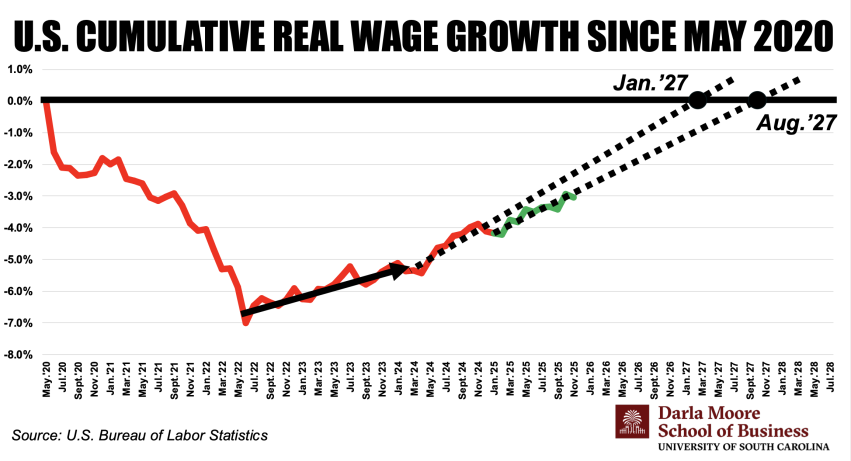

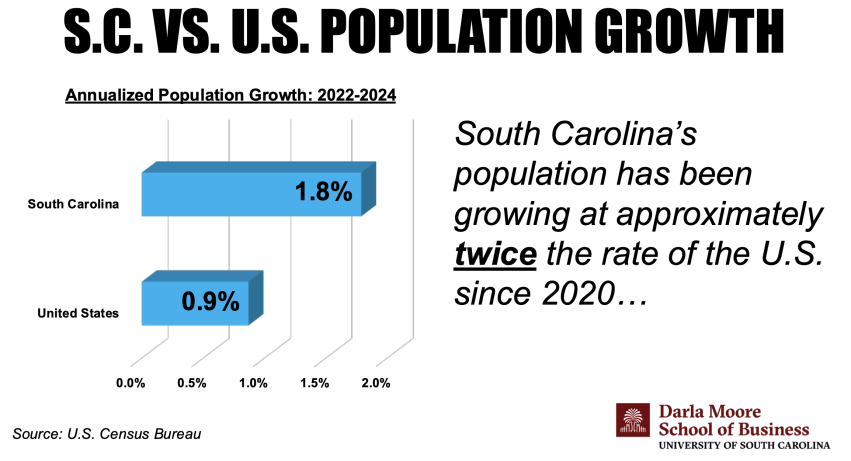

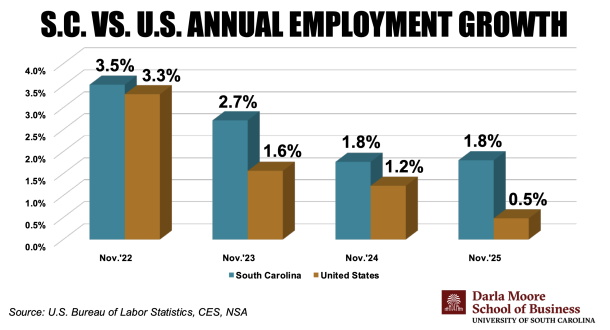

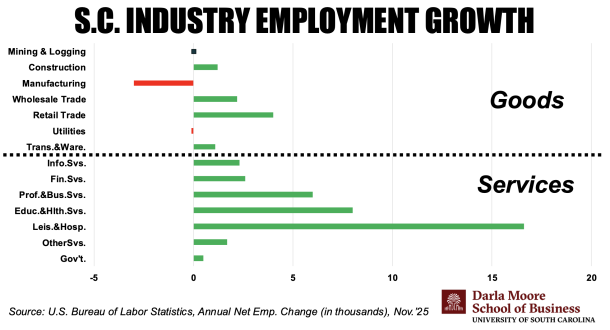

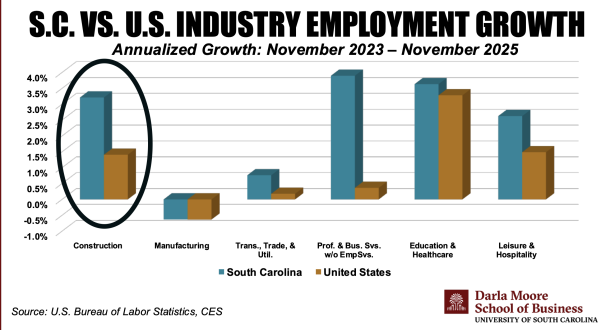

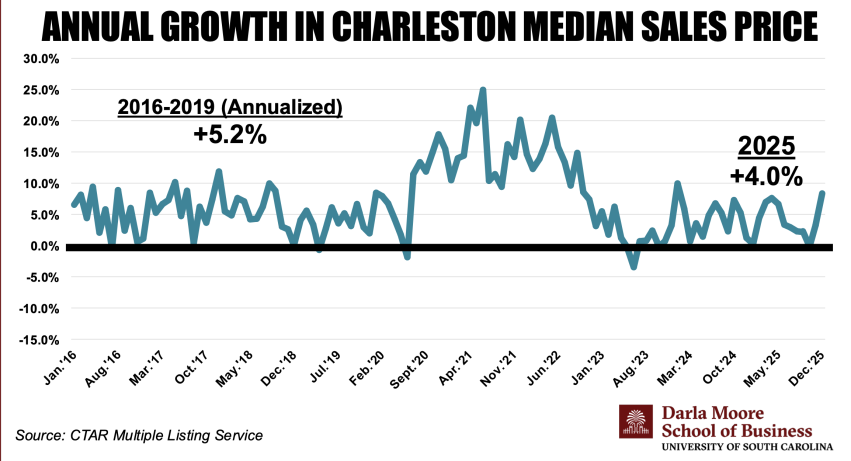

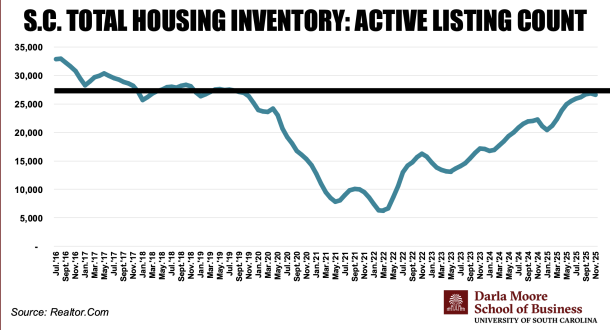

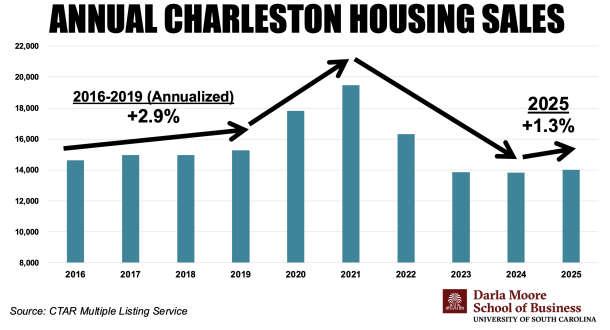

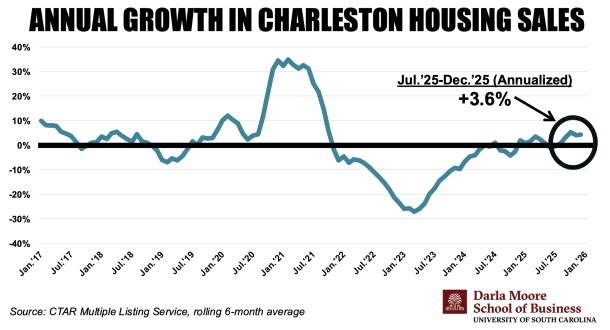

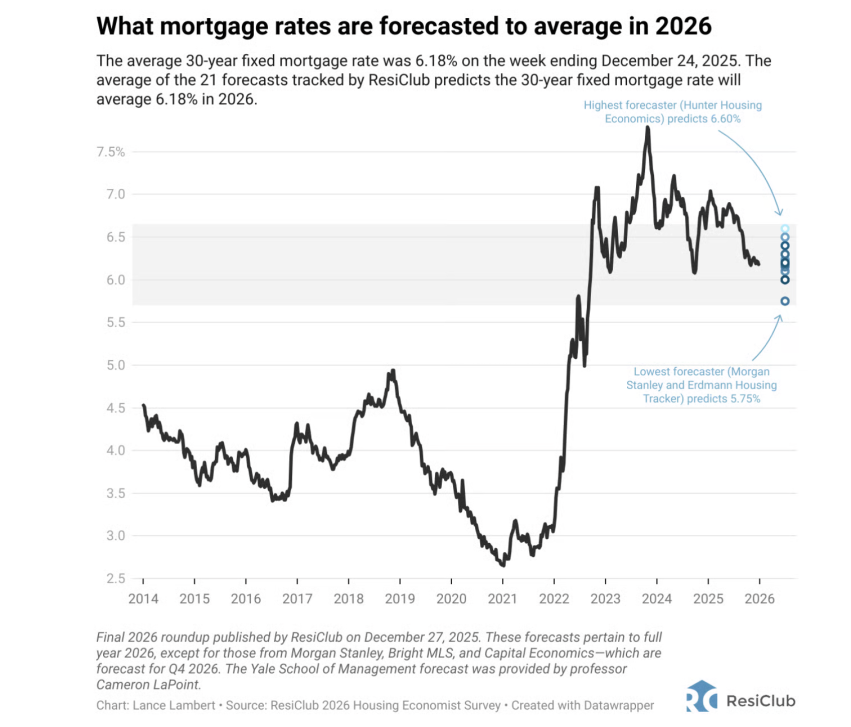

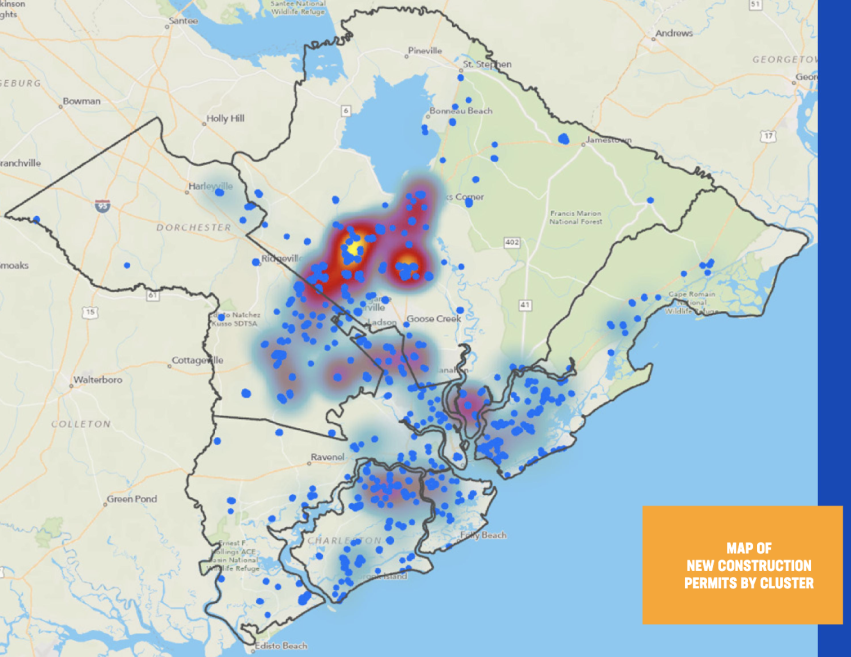

As we step into 2026, the economic landscape in South Carolina, particularly in the Charleston region, offers a mix of cautious optimism and steady progress. Drawing from the recent presentation by Dr. Joey Von Nessen, Research Economist at the University of South Carolina's Darla Moore School of Business, this forecast highlights key trends shaping the residential real estate market.