Tax Deferred Exchanges on Vacation Property

Death & Taxes. If you could defer either, would you do it?

Diet and exercise won't do much for your taxes but the 1031 Tax Deferred Exchange is an excellent tool for deferring capitals gains taxes on the sale of your investment property.

Disclaimer: We're not CPA's and we're not Attorneys. None of the information that follows should not be construed as tax or legal advice. Please consult with your own tax and legal advisors about your own unique situation. This is solely for information. .

First off, the key word here is 'investment' property. You must be able to establish that your vacation home has been held for investment, as opposed to a 'second' home. If you rented your vacation home more than 14 days for 'fair market rent' then it may qualify as investment property. On the other hand, if you spent more than 14 days of the year vacationing in the home personally, then it may be hard to justify to the IRS that it's 'primary purpose' is for investment. There are some other considerations related to how you file your taxes that may come in to play as well; so consult with your tax advisor on issues such as mortgage interest deduction, depreciation, and income reporting.

Secondly, you need to replace the property you're selling with 'like kind' investment property. Many people use the 1031 Exchange to trade up to a larger, nicer property while others may divest one large property in exchange for several, smaller investment properties. Either way, the two critical pieces of the formula are the Relinquished Property and the Replacement Property.

Property in vacation areas like the Isle of Palms, Wild Dunes and Sullivan's Island that is held for investment and rental income should qualify for a 1031 Tax Deferred Exchange. Another benefit of ownership is that all your ordinary necessary expenses should be deductible. These might include:

- repairs and maintenance

- mortgage interest

- insurance

- taxes

- depreciation

- management fees

If you own a second home and are concerned about a large tax liability upon sale, you can plan for the future by converting it to investment property. Some commons steps take include:

- limit personal use to 14 days or less in a year

- hire a property manager such as Carroll Realty to offer the home for rent

- list the property for rent on high-traffic sites like VRBO.com, HomeAway.com, etc.

So you've determined that you want to do a 1031 Exchange. What's next?

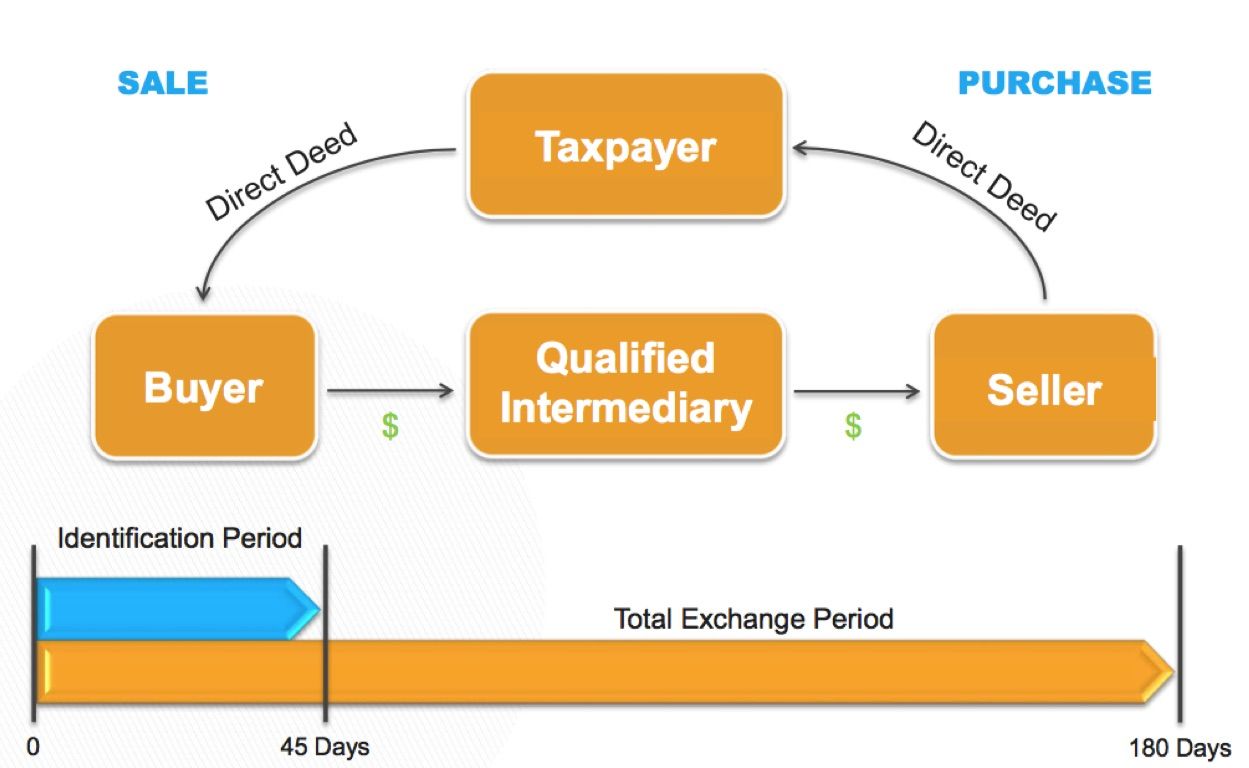

- Engage a Qualified Intermediary (QI). This person will receive the proceeds of your sale and subsequently purchase your replacement property on your behalf. The IRS requires specific documentation and there may be large sums of money involved so be sure to properly vet your QI. As your broker, we can refer reputable and knowledgable professionals.

- Watch your time! The clock starts ticking once you close on the sale of the Relinquished Property and you have 45 days to identify your Replacement Property. You must close on the Replacement Property(s) within 180 days of the first closing - OR before your tax filing date. So if you are beginning a 1031 Exchange late in the year, you may need to file an extension or plan accordingly.

- Identify your Replacement options. Most people follow the 'rule of 3' but there are other options available to you such as the '95% rule' and the '200% rule'. If you would like to know more about these options, please CONTACT US.

- QI will purchase and close on the Replacement Property before the 180 day deadline. The property is deeded to you or the entity of your choosing.

Important Note: The tax liability is still there; it's just deferred until you receive the profits. There is a concept called Constructive Receipt which your tax advisor can fully explain. Many investors simply roll their investment sale proceeds into one larger property after another and defer the taxes on those capital gains indefinitely.

So how much money could you save by doing a 1031 Exchange? Taxes on Capital Gains now comes from 4 different areas:

- Depreciation recapture at 25% +

- Federal Cap Gains tax at 15-20% +

- ACA tax on net income at 3.8% +

- Applicable state taxes up to 13.3%

So if your property has appreciated with the Charleston real estate market (see below), chances are a huge portion of your investment income will go to the tax man - unless you reinvest in like kind property in compliance with Sec. 1031 of the IRC.

We have assisted numerous clients over our combined 42 years in the sale and purchase of vacation homes and investment properties using the 1031 Tax Deferred Exchange. We want to see you maximize your real estate investments and the 1031 is an excellent strategy for properties that qualify.

Whether you want to upgrade that old vacation property into something bigger and better - or you're looking to redeploy your equity into smaller, more diverse holdings; we can help you! As always, reach out anytime even if you just have questions about 1031's or anything real estate related.